All Videos

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Bull and Bear Go To Market

Learn about the difference between bulls and bears—markets, that is!

Retirement Accounts When You Change Your Job

This video discusses issues related to your retirement accounts when you move on from your job.

What You Need to Know About Social Security

Every so often, you’ll hear about Social Security benefits running out. But is there truth to the fears, or is it all hype?

Retirement Plan Detectives

A couple become Retirement Plan Detectives, searching records from old employers.

Working With A Financial Professional

A financial professional is an invaluable resource to help you untangle the complexities of whatever life throws at you.

Leaving Your Lasting Legacy

Want to do more with your wealth? You might want to consider creating a charitable foundation.

Dog Bites and Homeowners Insurance

Reviewing coverage options is just one thing responsible pet parents can do to help look out for their dogs.

Retirement and Quality of Life

Asking the right questions about how you can save money for retirement without sacrificing your quality of life.

Behavioral Finance

An amusing and whimsical look at behavioral finance best practices for investors.

4 Elements of an Estate Strategy

Learn about the importance of having an estate strategy in this helpful and informative video.

The Wild West of Data Theft

Learn about cyber liability insurance in this entertaining video.

Stay Safe with a B.O.P. At Your Back

Learn about the advantages of Business Owner Policies with this highly educational and fun animated video.

Surprise! You’ve Got Money!

Here’s a quick guide to checking to see if you have unclaimed money.

18 Years’ Worth of Days

The average retirement lasts for 18 years, with many lasting even longer. Will you fill your post-retirement days with purpose?

Tuning Your Social Security Benefit

When should you take your Social Security benefit?

Saving for College 101

Here’s a crash course on saving for college.

The Latte Lie and Other Myths

Check out this video to begin separating fact from fiction.

It Was the Best of Times, It Was the Worst of Times

All about how missing the best market days (or the worst!) might affect your portfolio.

The Cost of Procrastination

Procrastination can be costly. When you get a late start, it may be difficult to make up for lost time.

When Special Care Is Needed: The Special Needs Trust

A special needs trust helps care for a special needs child when you’re gone.

Forecast

This short video helps explain why markets can be as unpredictable as the weather.

Surprises

Making the most of surprises is a great reason to work with us.

A Fruitful Retirement: Social Security Benefit

Taking your Social Security benefits at the right time may help maximize your benefit.

The Fed and How It Got That Way

Here is a quick history of the Federal Reserve and an overview of what it does.

How to Retire Early

Retiring early sounds like a dream come true, but it’s important to take a look at the cold, hard facts.

Keeping Up with the Joneses

Lifestyle inflation can be the enemy of wealth building. What could happen if you invested instead of buying more stuff?

Bursting the Bubble

Tulips were the first, but they won’t be the last. What forms a “bubble” and what causes them to burst?

Inflation and Your Portfolio

Even low inflation rates can pose a threat to investment returns.

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

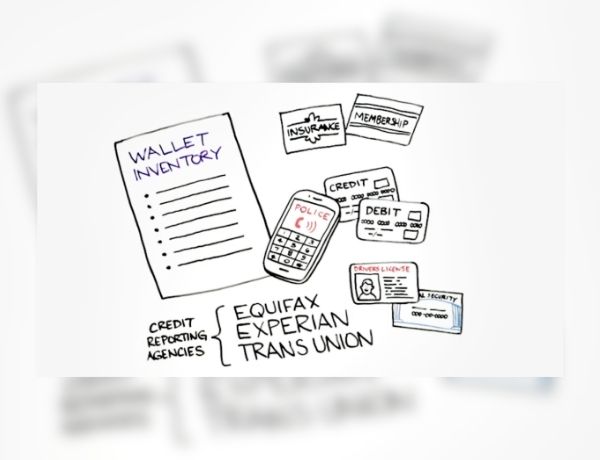

What to Do When You Lose Your Wallet

Ever lost your wallet? Frustrating. Here’s what you can do to keep yourself safe.

The Junk Drawer Approach to Investing

It's easy to let investments accumulate like old receipts in a junk drawer.

Suddenly Single: 3 Steps to Take Now

Have you found yourself suddenly single? Here are 3 steps to take right now.

Emerging Market Opportunities

What are your options for investing in emerging markets?

Global and International Funds

Investors seeking world investments can choose between global and international funds. What's the difference?

The Business Cycle

How will you weather the ups and downs of the business cycle?

Safeguard Your Digital Estate

If you died, what would happen to your email archives, social profiles and online accounts?

The Power of Compound Interest

Learn how to harness the power of compound interest for your investments.

Should You Invest in Exchange Traded Funds?

There are thousands of ETFs available. Should you invest in them?

Should You Tap Retirement Savings to Fund College?

There are three things to consider before dipping into retirement savings to pay for college.

Charitable Giving: Smart from the Heart

Do you have causes that you want to support with donations?

Estate Management 101

A will may be only one of the documents you need—and one factor to consider—when it comes to managing your estate.

Social Security: By the Numbers

Here are five facts about Social Security that might surprise you.

Making Your Tax Bracket Work

Have you explored all your options when it comes to managing your taxable income?

Exit Strategies of the Rich and Famous

Estate conservation is too important to put off. Do you have a smart exit strategy?

The Facts About Income Tax

Millions faithfully file their 1040 forms each April. But some things about federal income taxes may surprise you.

The Other Sure Thing

Though we don't like to think about it, all of us will make an exit sometime. Are you prepared?

The Cycle of Investing

Understanding the cycle of investing may help you avoid easy pitfalls.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG, LLC, to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.